Fit Hawkes on finance data¶

This example fit hawkes kernels on finance data provided by tick-datasets. repository.

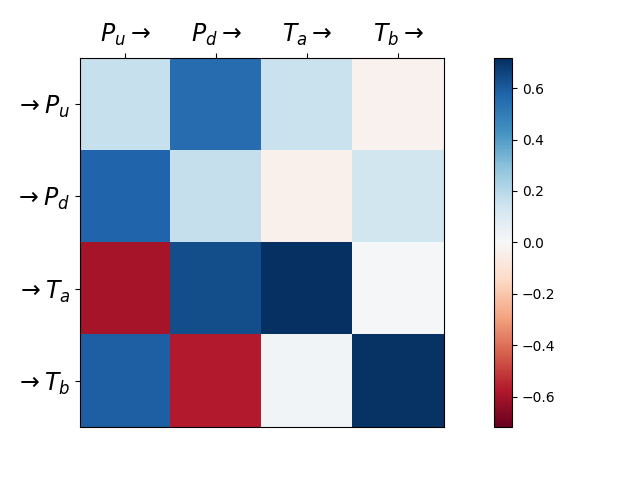

Kernels norms of a Hawkes process fit on finance data of Bund market place. This reproduces experiments run in

Bacry, E., Jaisson, T. and Muzy, J.F., 2016. Estimation of slowly decreasing Hawkes kernels: application to high-frequency order book dynamics. Quantitative Finance, 16(8), pp.1179-1201.

with \(P_u\) (resp. \(P_d\)) counts the number of upward (resp. downward) mid-price moves and \(T_A\) (resp. \(T_b\)) counts the number of market orders at the ask (resp. bid) that do not move the price. We observe expected behavior with for example mid-price moving downward triggering (resp. preventing) market orders at the ask (resp. at the bid).

Python source code: plot_hawkes_finance_data.py

import numpy as np

from tick.dataset import fetch_hawkes_bund_data

from tick.hawkes import HawkesConditionalLaw

from tick.plot import plot_hawkes_kernel_norms

timestamps_list = fetch_hawkes_bund_data()

kernel_discretization = np.hstack((0, np.logspace(-5, 0, 50)))

hawkes_learner = HawkesConditionalLaw(

claw_method="log", delta_lag=0.1, min_lag=5e-4, max_lag=500,

quad_method="log", n_quad=10, min_support=1e-4, max_support=1, n_threads=4)

hawkes_learner.fit(timestamps_list)

plot_hawkes_kernel_norms(hawkes_learner,

node_names=["P_u", "P_d", "T_a", "T_b"])

Total running time of the example: 2.24 seconds ( 0 minutes 2.24 seconds)

- Mentioned tick classes: